(Photo: Adobe Stock)

The last year has been exhausting for investors, with stock market indices on a rollercoaster ride. Still, some Quebec companies fared well, while others ended the past 12 months struggling. Offers presents the second edition of its annual Top 50 of Quebec Inc. for 2023 as well as some analysis of companies that have had good and bad returns over the past year.

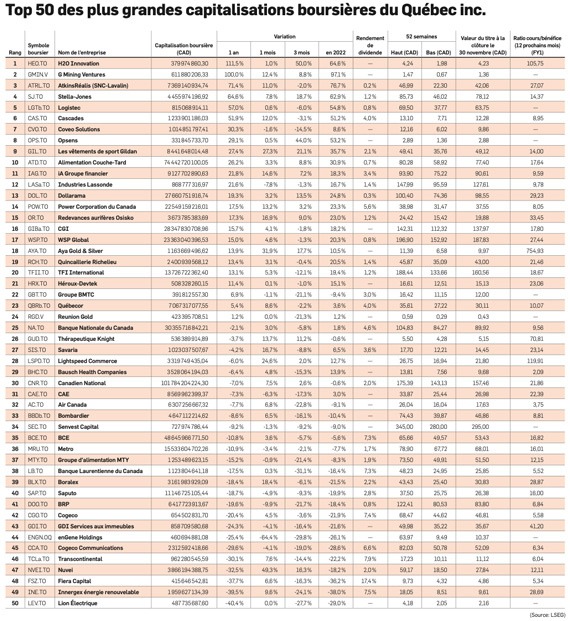

Methodology To compile our list, we selected the 50 largest companies by market capitalization based in Quebec. To find out which of them had the best (or worst) year, we looked at their performance over one year (December 1, 2022 to November 30, 2023). As you can see in the rankings, 24 of them had a positive return, which meant they outperformed Canada’s benchmark S&P/TSX index, which suffered a 1.48% decline for the year.

H2O Innovation — 1ahem

Not much has gone wrong at H2O Innovation over the past year.

On December 5, 2022, the company announced that it had secured two contracts in the United States with a total value of $12.1 million (M$), increasing its order for the Processing Technology business line. water and services at USD 55.1 million. Three days later, H2O revised its three-year strategic plan targets upward, with annual revenue growth of between 15% and 24% and an increase in margins of 120 basis points per year.

H2O added another contract through mid-December 2022 to bring its order book to $156.2 million, an increase of 83% compared to the previous year.

Desjardins seemed very excited about the overall order book, listed the company as its top investment ideas for 2023 and was bullish on its organic growth prospects.

The company was not going to make the financial institution lie. In May, when H2O released financial results for the third quarter of fiscal 2023, the company confirmed annual organic revenue growth of 18%. It was its sixth quarter of double-digit revenue growth.

The year of H2O Innovation ended with an acquisition. On October 3, Ember Infrastructure Management, a New York-based company specializing in environmental infrastructure and responsible investments, announced that it had entered into a definitive agreement to acquire the Quebec company for $4.25 per share. shares in cash, representing a premium of 68% to the stock price at the close of the Toronto Stock Exchange on the same day. The total amount of the transaction is 395 million dollars.

“This acquisition provides a good premium and crystallizes value for H2O shareholders,” said analyst Endri Leno of National Bank Financial at the time the purchase was announced.

The transaction was approved by H20 shareholders at the end of November and by the courts on December 1.

NEXT: G Mining Ventures — 2nd