El Salvador, the most crypto country in the world. With the spectacular re-election of its president Nayib BukeleTHE the fates of el salvador and bitcoin (and cryptoassets in general) will closely related for at least 5 more years. Crypto-Salvadoran news of the day comes to us this time Bitfinex Securitieswhich will help in issuing a the first tokenized debt in the Central American nation.

Warm Up Tokenization Before Volcano Bonds Explode?

Since Bitcoin has become legal tender September 7, 2021 in El Salvadorthe next big expected step is the release of the very first one State bonds in the world to be based on Bitcoin. He was calling Volcano jumps Or Volcano Tokenshowever, this tokenized debt was expected from him the very first mention at the end of 2021.

Yet, from January 2023El Salvador gained a “Ley de Emission de Activos Digitales” (Digital Asset Issuance Act), which was supposed to make this species possible tokenization real assets, or RWA (For Real world assets).

And precisely this Thursday, April 11, 2024 Bitfinex Securities – a branch specializing in tokenized financial securities of the Bitfinex crypto exchange – announces the release of a The very first debt (obligation) in form tokens in El Salvador:

“Bitfinex Securities Facilitates First Raise of Tokenized Assets in El Salvador: $6.25M in Tokenized Digital Assets for New Hotel at El Salvador International Airport.

Explore investment opportunities with HILSV tokens on Bitfinex Securities. »

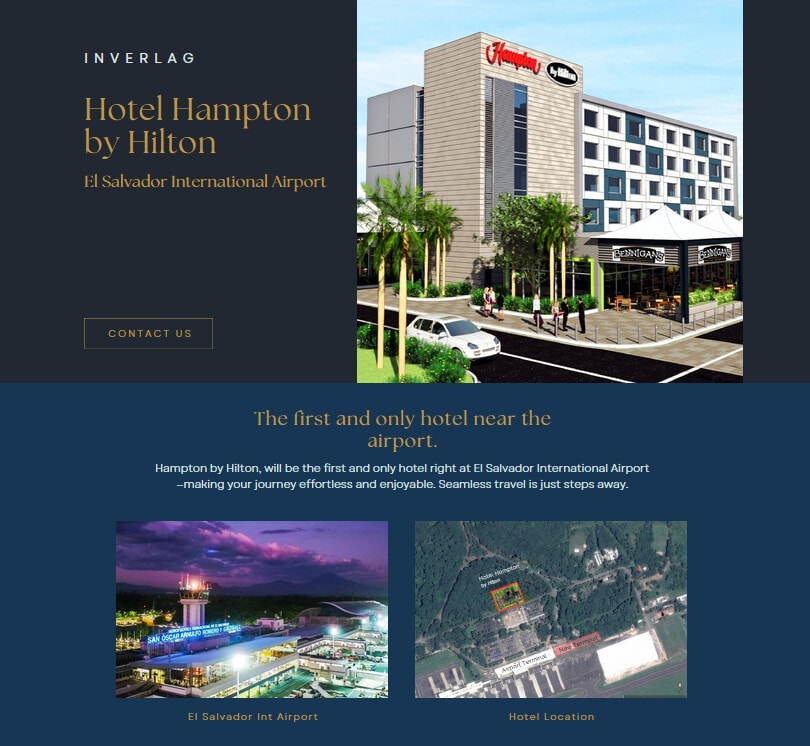

Hotel complex at El Salvador International Airport funded by tokenized fundraising

It is therefore for the construction of a resort based at El Salvador International Airport, that this first unprecedented issuance of tokenized debt will be made. The project mainly includes 80 roomsfive commercial spaces and hotel amenities such as a swimming pool, restaurant, gym, gardens and conference rooms.

Published by the company Inversiones Laguardiafundraising aims to raise funds from 6.25 million dollars. The bond will offer a 10% interest rate more than 5 years. Minimum investment will be 1000 dollars. Small incentives such as free hotel nights will be additionally offered to investors depending on the size of their participation.

Tokenized corporate debt issued on Bitcoin’s Liquid Network

The token of this bond will have an index HILSV. It will be released on Liquid networkside chain of the main network bitcoin. It can be purchased through American dollars or some USDT stablecoins Tether through the Bitfinex exchange platform.

“The HILSV token represents the first digital asset tokenization in El Salvador. It represents a significant milestone in the development of the emerging capital market as well as the introduction of a significant new asset class to the market. »

Paolo Ardoino, CTO of Bitfinex Securities and CEO of Tether

With recent approval non-taxation of foreign investments by the legislature of El Salvador, this kind of tokenized broadcast – very easy and fast access thanks to the advantages of blockchain networks – riskattract many investors from all over the world. As for the nation of Nayib Bukele, he is again taking another step towards full adoption bitcoins and cryptocurrencies.