A compromised assembly? – According to Fred Thiel, CEO of Marathon, Bitcoin may not experience a bullish explosion after the halving. Spot Bitcoin ETFs would already allow for a nice rally on the cryptocurrency king, and a halving should not have a significant price impact.

On-chain analysis could go the way of Marathon’s CEO. Unlike 2020-2021, miners are in the process of parting with their bitcoins. Considerable sales pressure, which must absolutely be compensated by demand. And when it comes to demand, all indications are that the cryptocurrency market has no shortage of it! This is a bitcoin newsletter.

Bitcoin price stagnates in 24 hours

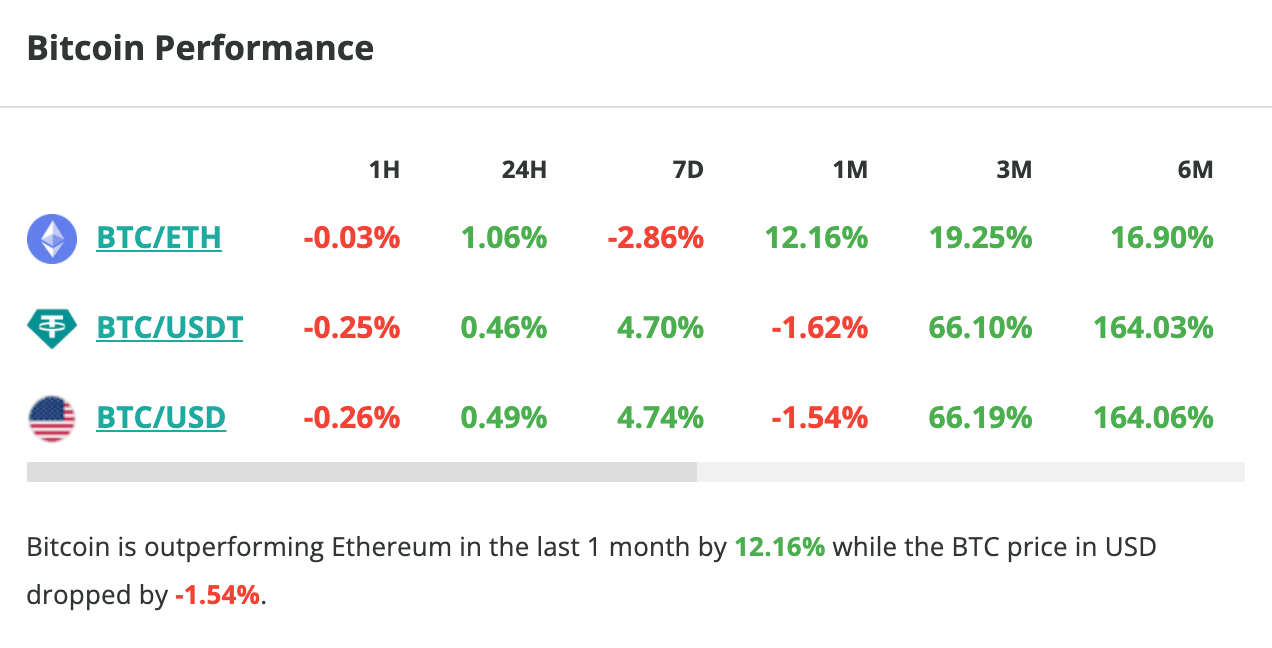

This weekend, buyers are fighting over keep $71,000. The price of Bitcoin is approx 4% to reach a new historical high. Will BTC be recorded and new ATH before halving ? Meanwhile, BTC stagnates in 24 hours and almost rises 5% in one week :

In one month, the king of cryptocurrencies down about 1.5%but it stays up 66% in three months. Bitcoin generally maintains an advantage over Ethereum because the BTC/ETH pair is in an increase of more than 10% in one monthand this despite the decrease almost 3% in one week.

Spot volumes explode to the upside: has the bull market started?

For the first time in its history, Bitcoin marked a a new all-time high before the halving. This is great news for crypto enthusiasts who hold BTC as their own portfolio developed well upwards from the beginning of 2023.

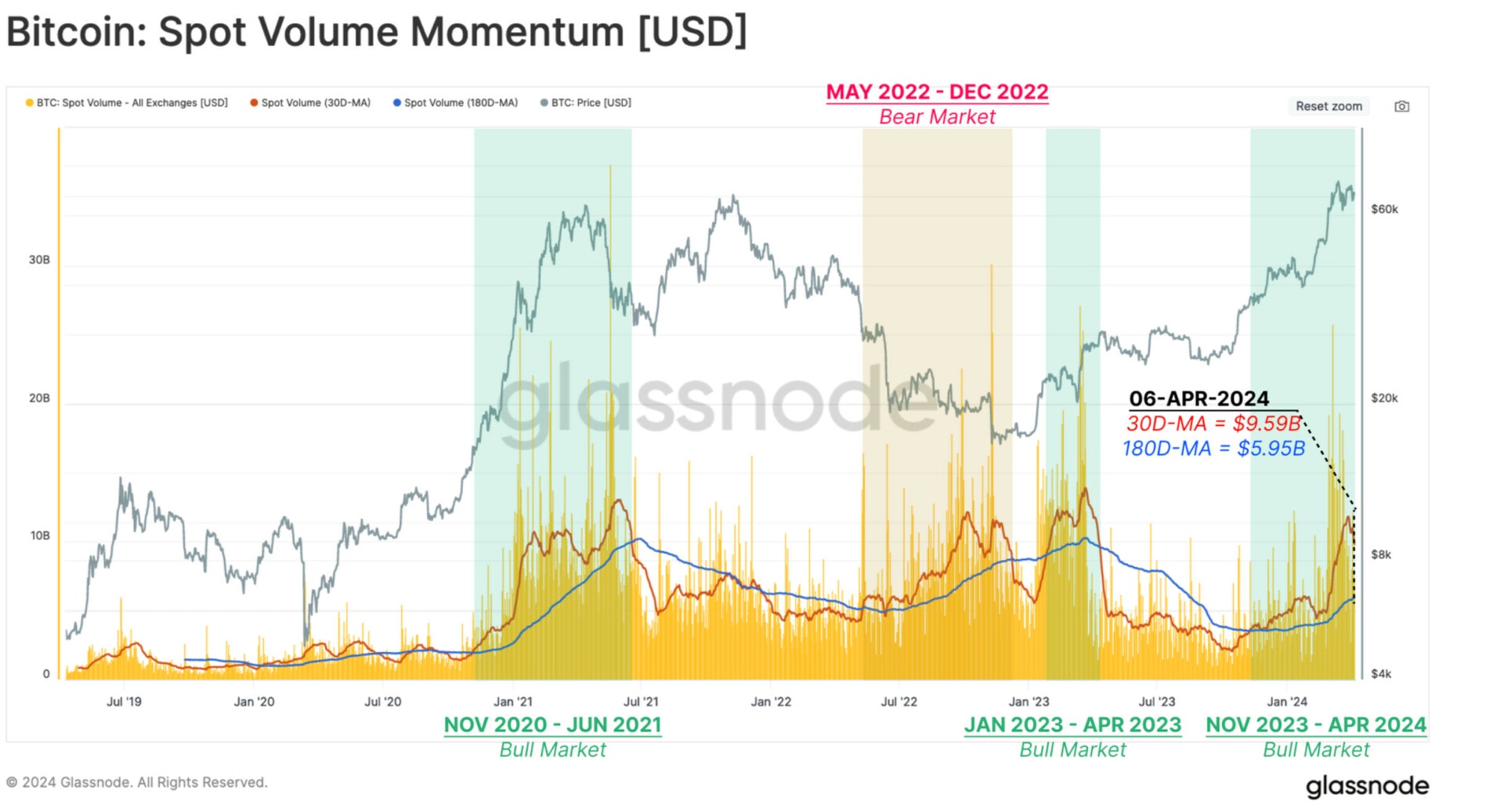

However, analysts seem to disagree on the current state of the market. Bull market, bear market ? If trading fees remain relatively low for a bull market,development of spot volumes is very encouraging:

A chart shared by Glassnode in its latest weekly report shows the current demand in the bitcoin spot market. Analysts applied 30 and 180 moving averages on spot volumesand the situation is similar to the last one 2020-2021 bull market. Actually moving averages are upward trendand it shows that demand in the bitcoin spot market is growing. A graph that suggests there is no shortness of breath For now. Meanwhile, the Z-Score of MVRV is still away from the excess zone which usually marks the tops of the market.

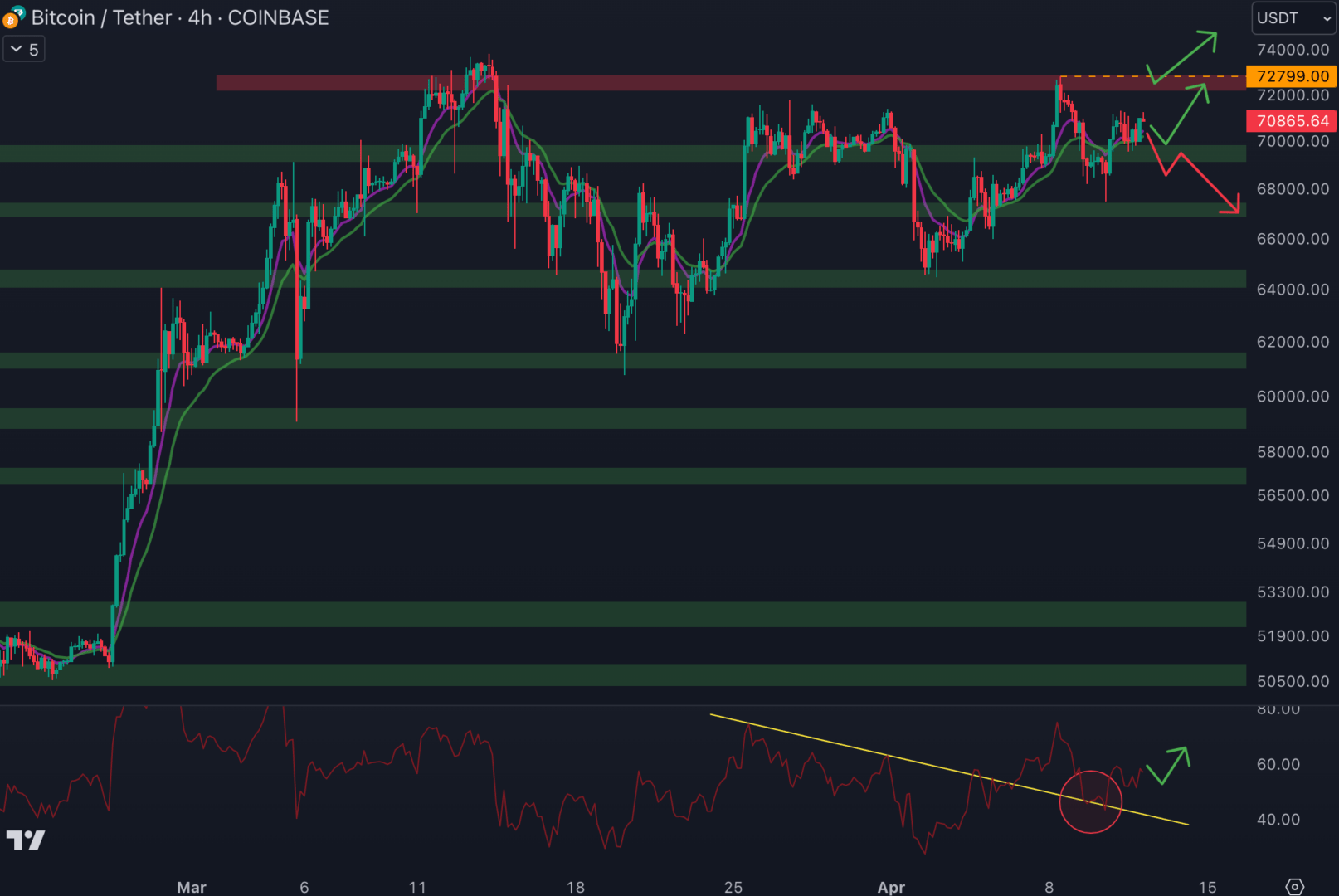

Will the sellers defend $72,500 again?

Buyers have won the battle at $69,500but they will win resistance war for $72,500. It is in fact the last resistance which separates BTC from a new all-time high:

Break in resistance at $72,500 would be synonymous with ATH on Bitcoin and the price could be even join the famous $80,000. It will be necessary for that maintain support at $69,500. Otherwise, the course could drop to $67,000. The RSI rebounded to the level bearish trend lineit will be necessary to continue creating ascending troughs and peaks on the RSI so that buyers are in control of momentum.

Spot volumes are rising as during bull markets, which is another indicator that is positive about Bitcoin’s situation. To reach a new all-time high, BTC will need to break through the $72,500 resistance. Solana (SOL) will need to push sellers to $200 resistance.