All eyes are on the bisect. As the halving scheduled for April 19-20, 2024 approaches, Bitcoin is preparing to relive a new historic moment.

Although it is often considered the trigger event for an uptrend, its immediate impact is shaped by a subtle combination of psychological and mathematical factors.

In this analysis, we will explore the inner workings of this cyclical event and provide insight into the strategies adopted by miners to cope with the challenges and seize the opportunities presented to them.

Understanding the Bitcoin Halving

The halving works to regulate the amount of new coins introduced to the network.

Along with gold, Bitcoin is designed to be rare and hard to come by. Rather than digging the ground for this precious metal, Bitcoin is mined using powerful running computers according to minors.

This analogy with gold is intentional and reinforces the perception of Bitcoin as store of value and means of long-term wealth preservation.

Miners are paid in BTC to provide computing power, assemble transactions into blocks, and build the blockchain.

This is called proof of work, or Proof-of-Work.

This reward is halved for every 210,000 blocks mined, which corresponds cycles of about 4 years in order to ensure the sustainability and security of the blockchain.

Using Glassnode to visualize this data gives us this representation:

Above the evolution of rewards represented by lines 🠠. Originally set at 50 bitcoins per block in 2009 (or approximately 7,200 BTC per month), this reward has been reduced to 6.25 bitcoins in 2020 and will be soon reduced to 3.12 bitcoins per block with upcoming halving.

A halving like no other for minors

Record revenues

Miners mine bitcoins by validating blocks and collecting transaction fees from network users.

Although they have record revenues and achieved a All-time high (ATH) in the first quarter of 2024, a halving could have a major impact on their future profitability.

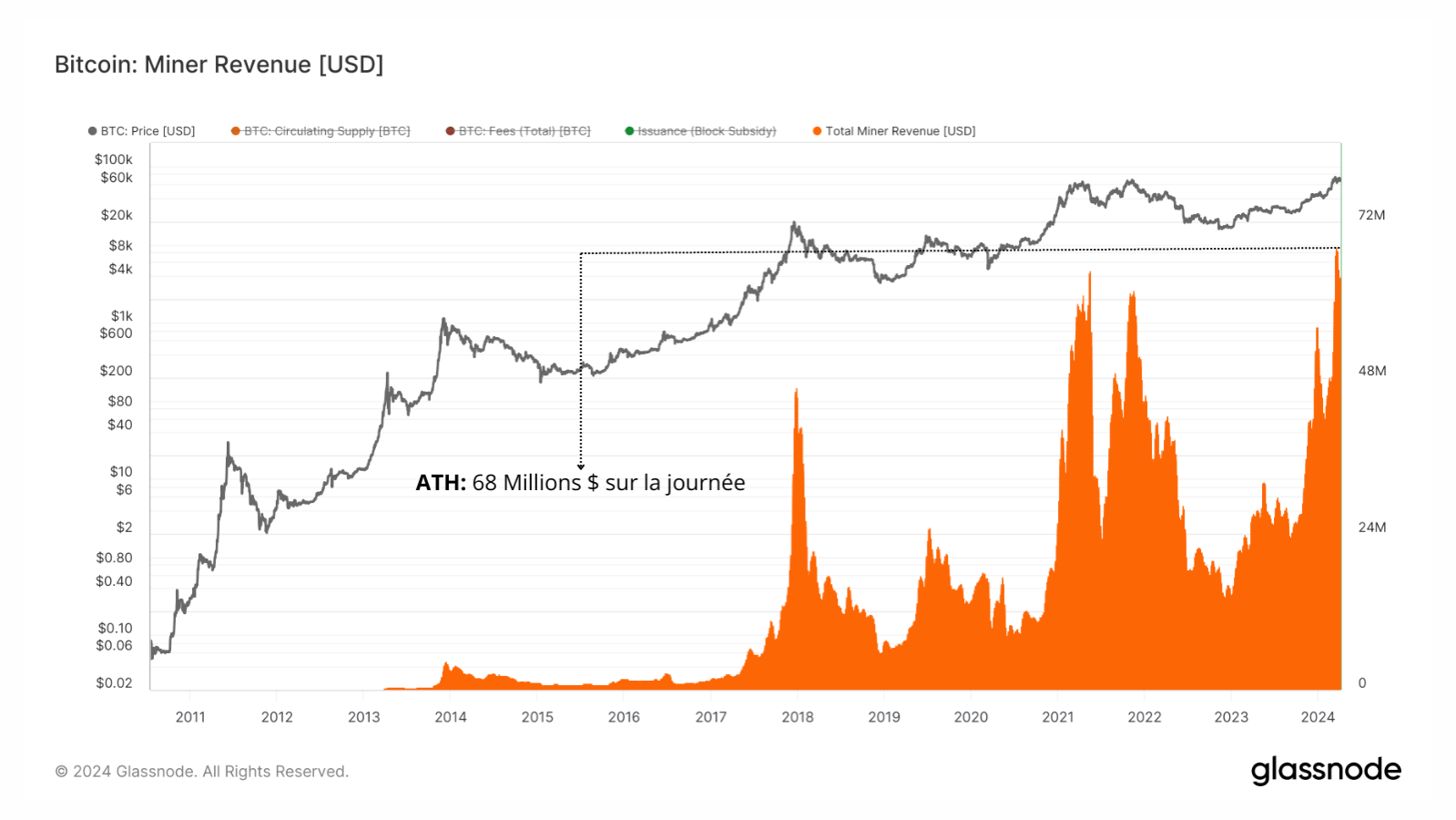

THE diagram below shows the volatility of miner income depending on where we are in the cycle and the price of bitcoin.

We have noticed that each market peak brings more and more peaks of income to the participants, namelyusually such profit levels are reached long after the halving and rarely very far from market peaks.

Miners’ daily earnings are currently $63 million, i.e. 3.6 times more than before the halving in May 2020.

Yet we are hitting a new all-time high amid utter market indifference.

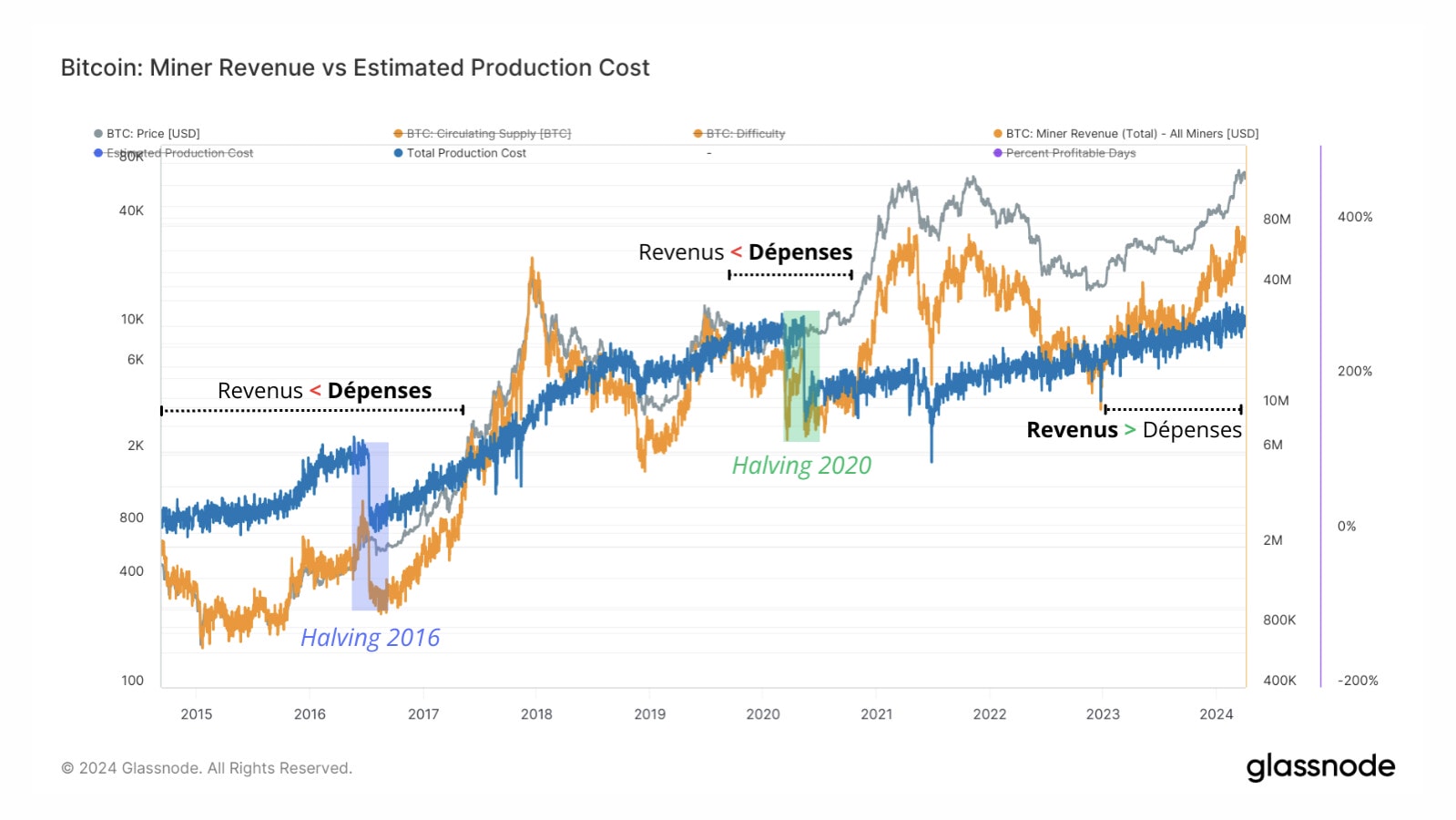

It should be said that we are nearing the halfway point, with miners largely in profit (in 🠠) compared to their production costs (in 🔵) as we can see in the image below.

This is only the second time this has happened.the first of 2012 so I am very curious to see if this level of gains will continue until April 20th.

As Fred Thiel, CEO of mining company Marathon Holdings Inc, notes:

“I think the approval of the ETF, which was a huge success, attracted capital to the market and basically pushed forward what could have been a price appreciation that we would normally see three to six months after a halving (…).

While for once prices were not falling before but rather rising, so everyone is obviously maximizing the situation, the halving is likely to have a modest effect on prices.”

Effect of reduction on minors

Reward cuts have already forced them to adjust their operations or even shut down in the past when production costs became prohibitive and the price of Bitcoin failed to sustain its profitability.

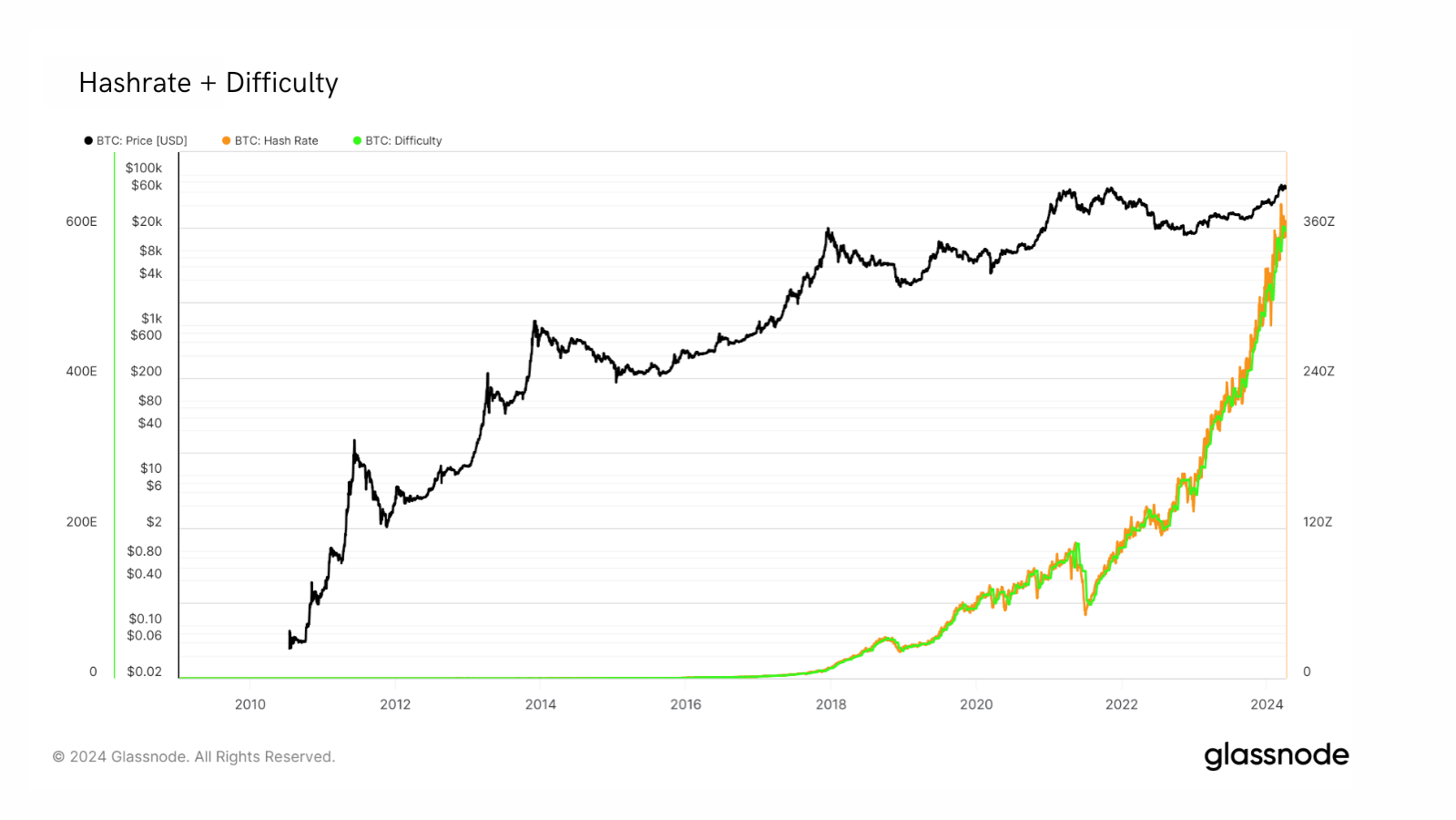

To understand their behavior, we look at the total computing power provided by all the miners in the network, as measured by hash rateand the complexity of what they have to solve, the so-called mining difficulty.

At the same time, miners face several significant changes compared to the previous halving:

- Income vs. Hashprice: As daily earnings reach new highs, the hashprice (revenues per hash received by miners) is 30% lower, signaling a reduction in earnings per work effort (logical as rewards have decreased, but not the workload of minors).

- Lower transaction fees: A significant drop in these fees puts further pressure on miners’ profitability (the network is not yet congested).

- Intensification of competition: Bitcoin network hashrate has increased significantly as seen in this diagram (x5 as of May 2020), indicating increased competition among miners for the same rewards.

Logic would then dictate that we play it safe and expect a temporary stoppage of traffic by the miners around the bisection. However, since the price of Bitcoin is very high, will it feel the same pressure as in previous cycles, as estimated by CEO Fred Thiel?

Their revenue will certainly suffer, but won’t they still be profitable enough to withstand the consequences of this event?

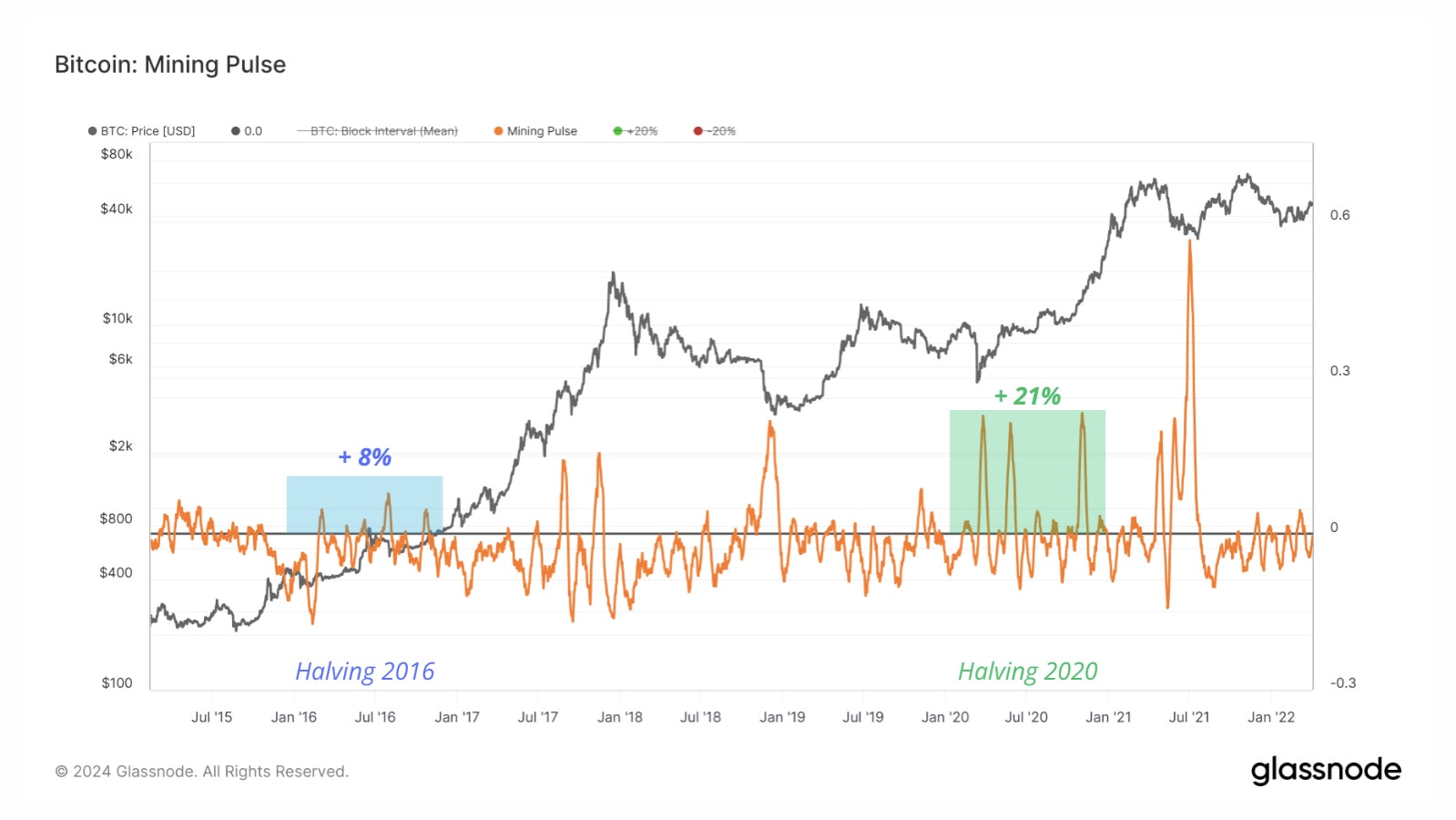

A concrete example of the impact of halving s Mining impulse (metric below)

- This indicator reacts when blocks are mined slower or faster than usual.

- It shows positive values when it takes more time to verify a block, or negative values when it is verified faster (curve 🟠).

On diagram We noticed that during previous halvings, miners were under pressure and disconnected their machines (zones 🟦 and 🟩 show peaks of block verification slowness).

On the other hand, if less efficient miners decide to suspend their operations due to rising costs, active miners who remained connected could see an increase in profitability (less competition for the same rewards means more profits).

Miners like to take profits!

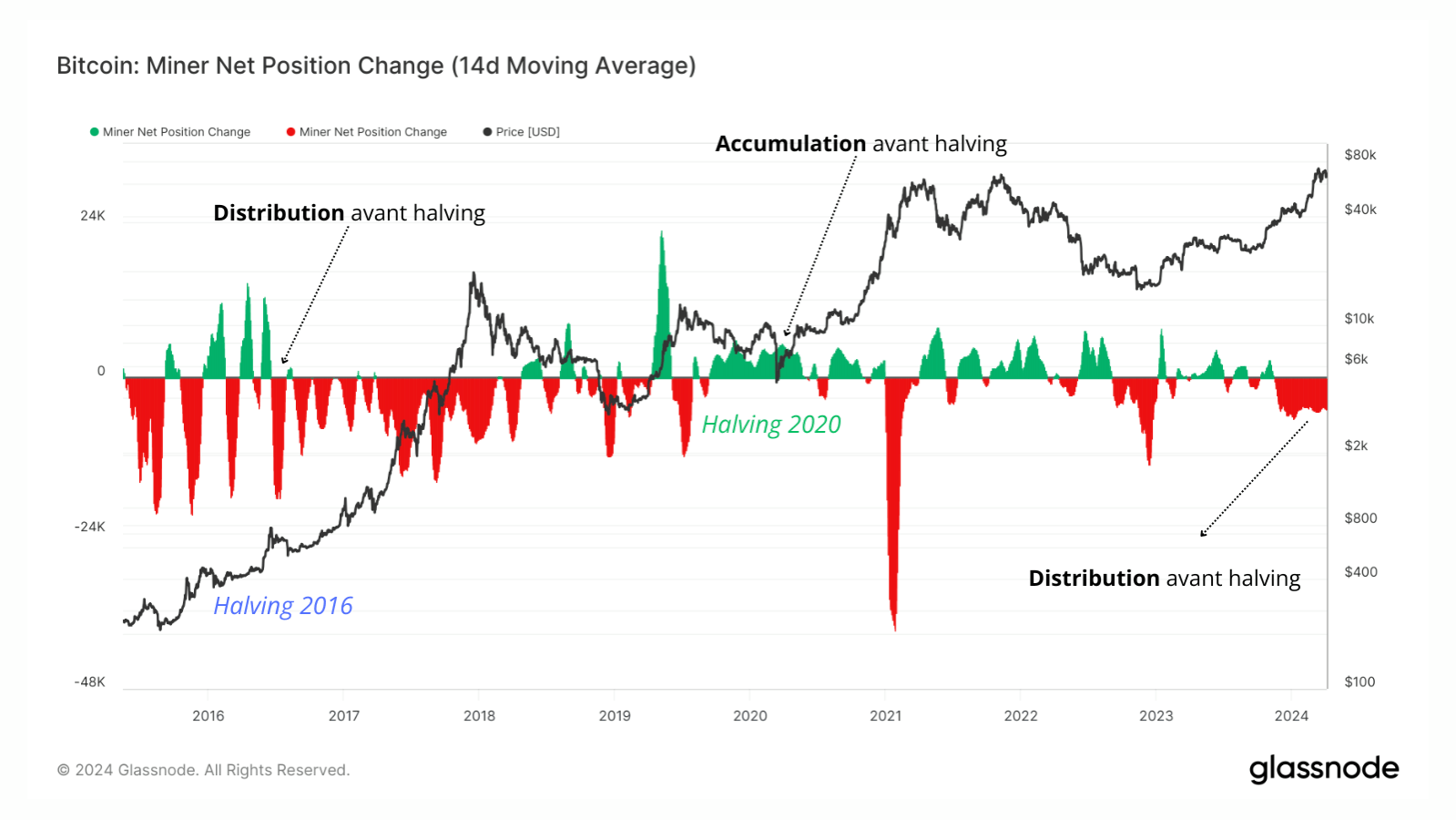

In this context, the miners decided to sell part of their bitcoins before the halving, and this started from October 2023, as stated in diagram bottom.

This behavior is certainly motivated by two things:

- Take profits after 6 months of rising prices and substantial profits.

- Anticipation of an upcoming decline in their income.

This collection of profits will allow them to invest in newer or new mining equipment.

As time goes by they become more and more efficient and move from CPUs to GPUs to FPGAs and then ASICs, this will lead to an increase in hashrate and therefore an increase in mining difficulty as these technological developments continue.

It’s a snake that bites its own tail! However, this is necessary to remain competitive in a market that is evolving very quickly.

If it is currently very profitable to be a mining company at this stage of the cycle, the Bitcoin halving, much more than just an algorithm update, is a significant cyclical event that deeply disrupts the economic and technical balance of the cryptocurrency market and its players. .

For miners, it presents both profitability challenges and customization opportunities that potentially shape the future of blockchain in the coming months and years.